SOCIAL SECURITY OPTIMIZATION

What You Need To Know To Optimize Your Social Security Benefits And Make Your Personal Savings Last

Our specialized class offers real world strategies and methods designed for those who are preparing for retirement and want to know more about the Social Security retirement system. This includes the important benefit filing rules that determine the amount of retirement benefits you collect, as well as strategies for coordinating Social Security with other sources of retirement income.

What can you expect to learn from this class?

When you are first eligible to collect benefits and how the age at which you apply will affect the monthly amount you receive

How to coordinate Social Security benefits with pension and IRA assets on a tax efficient basis

How cost-of-living-adjustments impact benefits

When to leverage strategies that will maximize your benefit while collecting from a former spouse

The effect of remarriage on survivor benefits for widowed and divorced spouses

How current employment will impact your ability to collect benefits

Navigate The Complexities Of Social Security With Confidence

One of the most important decisions you will be required to make before you retire is when and how to claim Social Security benefits. The majority of retirees apply for benefits as soon as they become eligible, at age 62. For many however, they do so without realizing they are significantly and permanently reducing the benefit amounts they and their spouse will have the opportunity to receive throughout their lifetime.

Whether you’re single, married, divorced or widowed, there may be ways to optimize the amount of lifetime, after tax, benefits you and your family receive from Social Security. This class will address how making sound decisions could potentially enhance your retirement income by focusing on these key areas: optimizing Social Security benefits, making informed retirement plan distribution decisions, creating a “do-it-yourself” personal pension, and understanding how income taxes change in retirement.

Join us to unlock expert insights and receive actionable tips that will empower you to optimize your Social Security effectively, paving the way for a more stable and prosperous retirement.

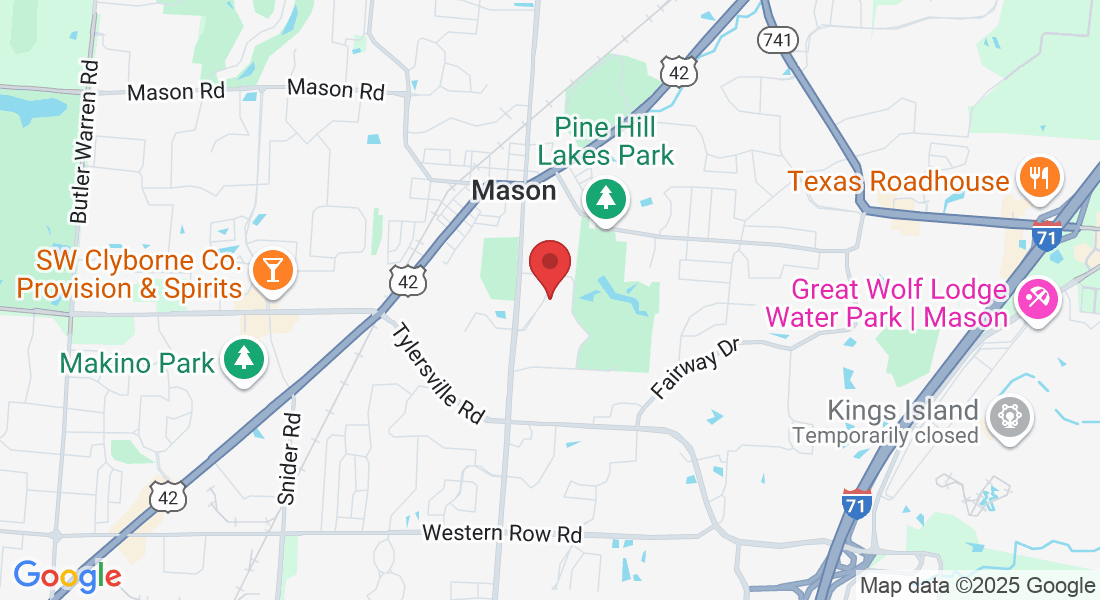

You're invited to the Mason Community Center for this informative, no-obligation class focused on Social Security Optimization on your choice of EITHER Tuesday, April 15th OR Thursday, April 17th at 6:30 PM ET.

*The instructor belongs to Non-Profit Adult Financial Education Council, and is one of only 20 in the state of Ohio who are a certified Social Security Strategist Instructor.

The class aims to give you the latest and most comprehensive insights into Social Security optimization and how to navigate the intricacies. This includes effective strategies for maximizing your income in retirement, how to file for Social Security, what may impact your Social Security check, how to navigate taxes, and how to optimize your money. Armed with the knowledge acquired during this class, you'll be better equipped to formulate a successful retirement plan that has the potential to shield you from the complexities in your golden years, ultimately saving you money.

Join us on 4/15/25 at 6:30 PM ET or 4/17/25 at 6:30 PM ET for this specialized, no-obligation class.

Space is limited. Sign up today!

TUESDAY

April

15

6:30 PM ET

THURSDAY

April

17

6:30 PM ET

Frequently Asked Questions

Who is this class for?

The details shared during our class can benefit individuals who have already retired, as well as those nearing or simply wanting to prepare for retirement.

What's the purpose of this class?

This class is 100% educational. Presenters may distribute their business cards or brochures to offer information about their company. Attendees are NOT obligated to interact with the speaker during or after the class.

Who is the speaker/presenter?

Andy Boettcher is a licensed agent in Ohio, Kentucky and Florida and many other states with over 15 years of experience in financial and estate planning. As an active member of his community and church, he takes serving his fellow tri-state residents seriously. Andy has made it his personal mission to enrich people’s lives through financial education, ensuring their retirement needs are met and providing peace of mind.

First and foremost, Andy is a family man with 3 children. When not at work, Andy runs an antique business, combining his love of entrepreneurship and the hunt for unique treasures at estate sales and flea markets.

With A to Z Retirement Planners, Andy will truly make you a member of the family when you discuss the best options for your unique financial situation. His expertise in senior income planning, estate planning, and long term care options will ensure that your family's needs are taken care of and your assets are safe.

Andy holds a Bachelors of Science from the University of New Hampshire. He is also a Certified Social Security Strategist, and a frequent conference speaker on the topics of Social Security Optimization, Estate Planning, Medicare, Life Insurance and other financial topics.

Copyright 2025 . All rights reserved.

This class is strictly informational. No investments will be promoted. However, the Financial Professional presenting may invite you to a follow up consultation where financial products may be presented or offered. This presentation has not been endorsed by the Social Security Administration. Neither Retire101, Divergent Financial Group Corp, nor the Financial Professional presenting this seminar are affiliated with the Social Security Administration or any other governmental organization.